As 2024 draws to a close, gold and silver have experienced a remarkable year characterised by record-breaking gold prices and significant volatility. Driven by a complex interplay of global economic factors, geopolitical tension and shifting monetary policies, gold reached an all-time high of USD 2,790, outperforming many analysts' predictions and cementing gold's status as a safe-haven asset in times of uncertainty. Silver also posted a strong year but is still fighting to leave its 4-year trading range below USD 30 behind. Generally, the market's trajectory was influenced by several key elements, including the Federal Reserve's interest rate decisions, persistent inflationary pressures, escalating geopolitical risks and robust demand from central banks and investors seeking to hedge against economic instability.

1. Review

The year 2024 proved to be exceptionally successful for precious metals gold and silver. On a US dollar basis, the gold price reached a new all-time high of USD 2,790 on 31st October. Currently, it shows an impressive increase of +27% since the beginning of the year. Silver hit a 12-year high of USD 34.89 and is up about 28.8% year-to-date. In euro terms, the gains were similarly impressive, with gold up around 34% and silver up about 35.3%. This performance underscores the role of precious metals as a safe haven and stable portfolio anchor in a volatile market environment.

The rally began in October 2023 and was further intensified by geopolitical tensions such as the Ukraine conflict and escalation in the Middle East throughout the year. Despite intermittent pullbacks, the uptrend remains intact. However, precious metal prices have undergone a multi-week correction or consolidation at a high level since the end of October.

1.1 Key Drivers

A significant driver for the price increases was the rising demand from emerging markets like China and India. Silver, in particular, benefited from its use in future technologies such as solar energy and electric cars. Simultaneously, production bottlenecks led to limited supply, further driving up prices. Central banks, including the People’s Bank of China, also increased their gold reserves, generating additional demand. Inflation and monetary policy developments also contributed to the attractiveness of gold and silver. High inflation rates prompted investors to invest in inflation-protected assets. The US interest rate turnaround and expectations of further rate cuts reduced the opportunity costs of holding precious metals.

Overall, gold and silver confirmed their stability and relevance as long-term stores of value in an uncertain global environment in 2024. These developments reflect the growing interest in precious metals as a strategic reserve.

2. Chart Analysis – Gold in US-Dollar

2.1 Weekly chart: The correction has neutralised the Stochastic Oscillator

Gold in US-Dollar, weekly chart as of December 19th, 2024. Source: Tradingview

Gold in US-Dollar, weekly chart as of December 19th, 2024. Source: Tradingview

Since reaching a new all-time high of USD 2,790 on 31st October, gold has corrected over the past seven weeks, retracing previous gains amid sometimes volatile fluctuations. The low point of this correction was seen on 14th November at USD 2,535. Subsequently, recovery attempts failed twice in the area around USD 2,725, each time leading to a new wave of selloffs.

The Stochastic Oscillator, however, remained unimpressed by these recovery efforts and has activated a sell signal on the weekly chart since the end of October. The initially strongly oversold condition has now been significantly reduced. Currently, there is no oversold momentum. The current constellation would no longer oppose a resumption of the rally.

Overall, the weekly chart still appears bearish. It will require a more significant recovery and at least one or two strong weeks before the Stochastic can generate a buy signal again. Over the coming weeks, a broad trading range between USD 2,600 and USD 2,700 is primarily expected.

Only a rise above the previous week’s high of USD 2,726 is likely to trigger an attempt at the all-time high of USD 2,790. Below USD 2,585, however, the bears would prevail. In this case, the correction could extend considerably and potentially bring new lows below USD 2,535.

2.2 Daily chart: Trend Reversal right after the last US interest rate decision of 2024

Gold in US-Dollar, daily chart as of December 19th, 2024. Source: Tradingview

Gold in US-Dollar, daily chart as of December 19th, 2024. Source: Tradingview

Right on cue for the year’s final Fed interest rate decision, the gold price was pushed down to a low of USD 2,583 on Wednesday evening. The sell-off, starting from USD 2,726 10 days ago, has the character of a final capitulation. A few days later, gold is trading nearly USD 40 higher.

This fully meets our expectation of a correction until mid-December. As often in recent years, gold might have initiated a trend reversal shortly before Christmas and could begin a new upward trend, which typically should last until next spring, at least.

From a technical perspective, Wednesday’s low marks a slightly higher low compared to the 14th November low of USD 2,535. While the 50-day moving average (USD 2,668) was lost during last week, the strongly supportive 200-day moving average (USD 2,474) remains far below current price action. Overall, gold prices have been moving sideways roughly between USD 2,600 and USD 2,700 since 6th November.

Encouragingly, the correction of recent days has pushed the Stochastic Oscillator to the oversold zone, making a new buy signal and an upward reaction highly likely.

In sum, the daily chart is bullish due to the strong trend reversal of around USD 40. We now expect at least a more or less direct recovery back to the 50-day moving average or approximately USD 2,665. There, it will be decided whether the bulls have enough strength for an attack on the upper Bollinger Band (USD 2,702) or if another pause is needed.

If the bulls manage to bend the upper Bollinger Band upwards in the next step or the one after, not much stands in the way of an attack on the all-time high in January.

3. Commitments of Traders for Gold – Bearish

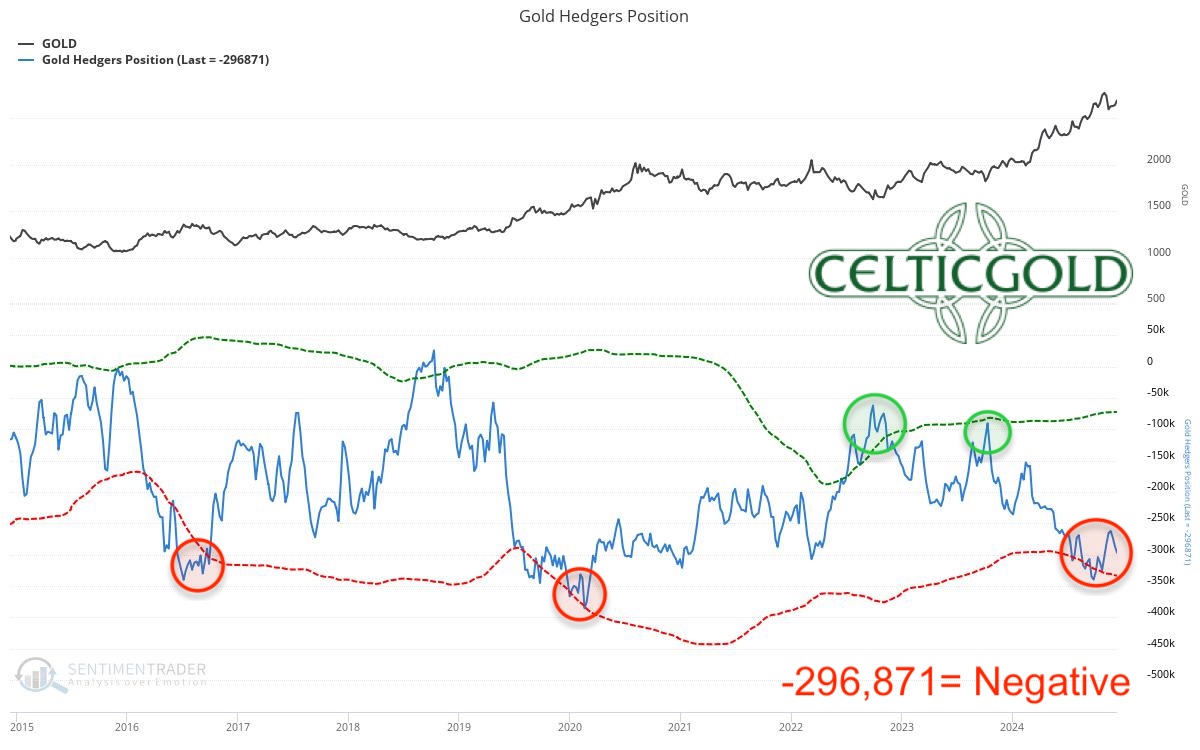

Commitments of Traders (COT) for gold as of December 10th, 2024. Source: Sentimentrader

As of the closing price of USD 2,693 on Tuesday 10th December, commercial traders held a cumulative short position of 296,871 gold futures contracts. Despite the ongoing correction since late October, the situation in the futures market has not significantly improved. Instead, professionals continue to see a very high need for hedging.

Overall, the Commitments of Traders (CoT) report remains negative and clearly bearish. Substantially lower gold prices would be necessary before this component of our analysis could be interpreted as neutral or even "contrarianly" bullish.

4. Sentiment for Gold – Too optimistic

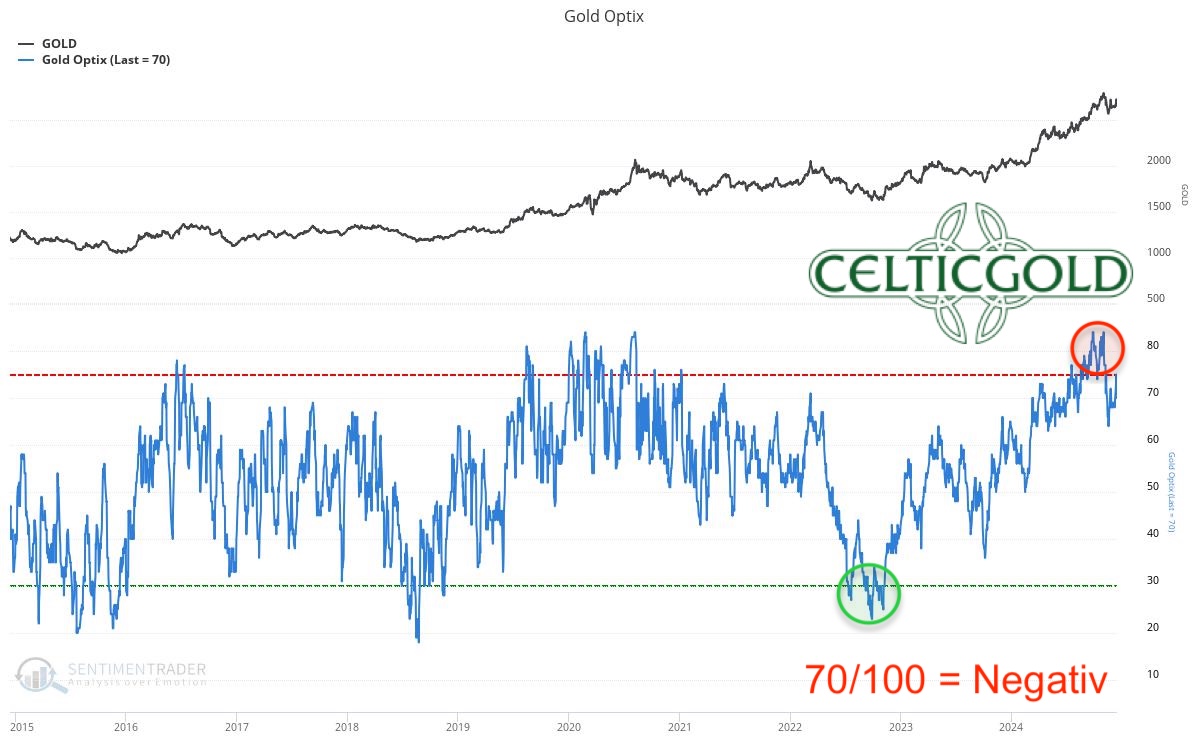

Sentiment Optix for gold as of December 18th, 2024. Source: Sentimentrader

The OPTIX sentiment index in the gold market has recovered after a temporary cooling in November and is approaching the euphoria zone with 70 out of 100 points. This contrasts with the recent price action, which has been rather subdued in the past few days and weeks. This discrepancy indicates a deeply rooted bullish attitude among market participants, established after the two-year upward movement.

However, this optimistic “buy the dip” sentiment carries risks, as markets almost always seek the path of maximum surprise and pain. In other words, when a large majority of market participants reach a consensus, they are usually wrong, and the opposite often occurs.

Nevertheless, in bull markets excessively optimistic sentiment can persist for extended periods. During such phases, short but sharp pullbacks, like those seen in recent days, serve to reduce excessive optimism or, figuratively speaking, “let out the hot air.” This allows for a continuation of the uptrend, with sentiment indicators potentially pushing back into the euphoria zone.

In summary, optimism in the gold market remains too high despite the recent pullback. However, it does not immediately stand in the way of resuming the upward movement.

5. Seasonality for Gold – Shifting to strongly bullish

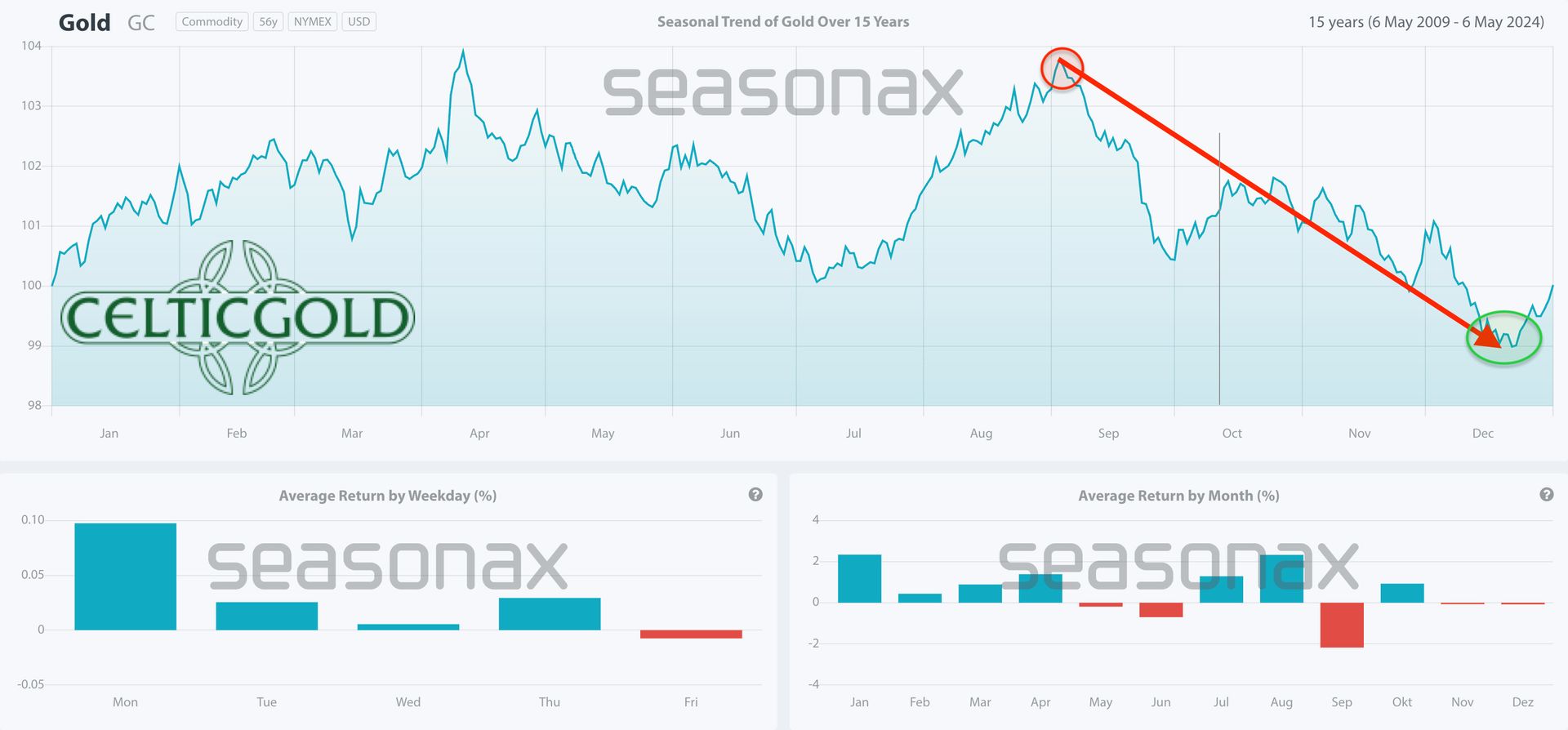

Seasonality for gold over the last 15-years as of May 6th, 2024. Source: Seasonax

Seasonality for gold over the last 15-years as of May 6th, 2024. Source: Seasonax

Indeed, gold has adhered quite well to its seasonal pattern in recent weeks, undergoing a correction. Typically, the low point should be found around the last Fed interest rate decision of the year. Subsequently, gold should rise significantly in the coming months until spring 2025.

Overall, seasonality is shifting to strongly bullish in these days and could drive precious metal prices to new highs in the coming months.

6. Macro update – Worldwide Crack-Up-Boom ignores German chronic weakness

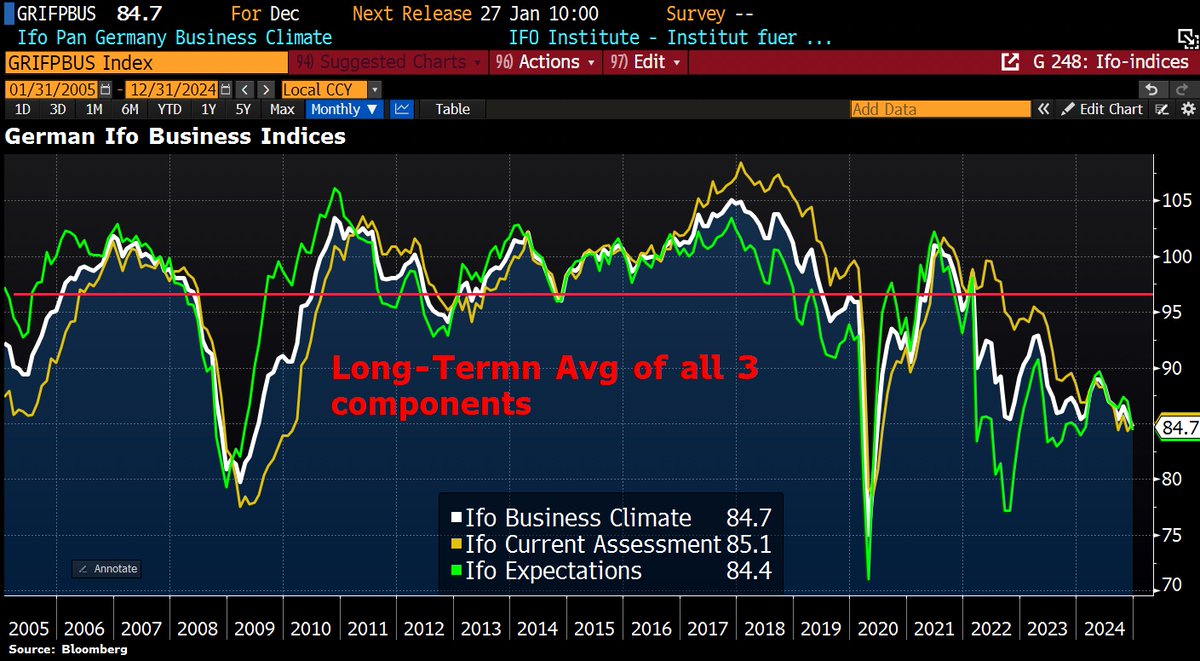

German Ifo Business Climate Index, as of December 17th. 2024. Source: Holger Zschäpitz

The year 2024 was marked by persistent challenges for the German economy. The economic weakness has become chronic. The gross domestic product (GDP) contracted by 0.2%, leading Germany into its second recession phase since 2023. Particularly concerning was the 1.5% decline in industrial production, a key indicator of the country’s economic strength. The unemployment rate rose to 6.0%, highlighting the labour market’s strain due to uncertain economic parameters and technological transformation processes. While the inflation rate of 2.2% was below the previous year’s value, energy prices and volatile commodity markets continued to exert pressure on consumer prices.

6.1 German Ifo Business Climate Index at Lowest Level Since May 2020

The ifo Business Climate Index fell to 84.7 in December, its lowest level since May 2020. This is well below the long-term average of 96.6 and appears very weak compared to recent years. Since the start of the war in Ukraine, the index has averaged only 88.2.

6.2 Global Context

In the global context, a more differentiated picture emerged. World economic growth at 3.1% was significantly above the German average, with the Asia-Pacific region acting as a growth engine. The USA benefited from robust consumer demand and ongoing fiscal stimulus, while the effects of earlier trade conflicts and deregulation measures were still noticeable. In Europe, growth rates varied, confirming the continent’s structural challenges. Despite these global dynamics, Germany remained characterised by economic stagnation, exacerbated by structural problems and global uncertainties.

6.3 Magnificent Five Undeterred by Geopolitical Risks

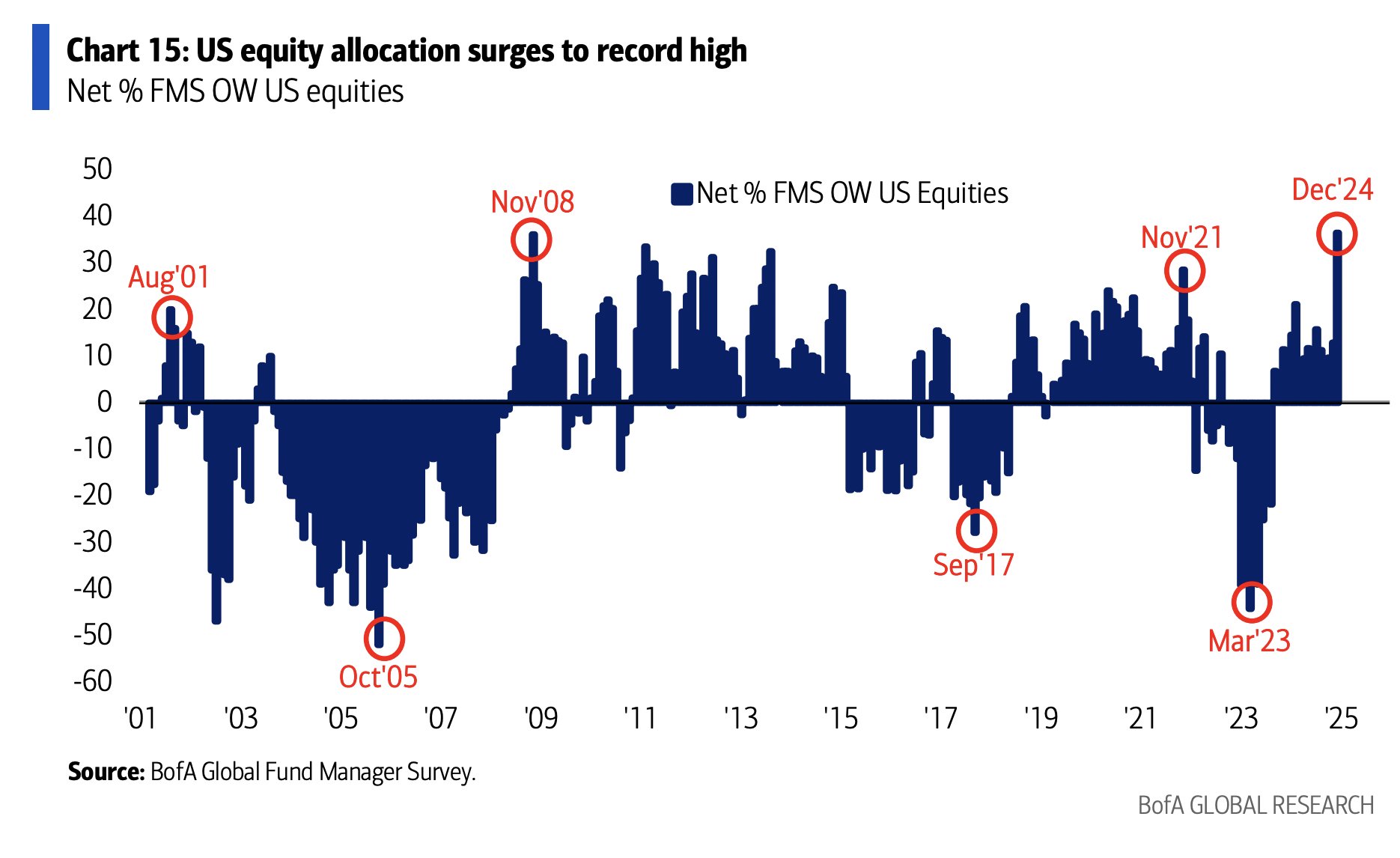

US equity allocation surges to record high, as of December 17th. 2024. Source: BoFA Global Research

US equity allocation surges to record high, as of December 17th. 2024. Source: BoFA Global Research

Financial markets continued to be marked by escalating geopolitics. Nevertheless, American stock markets were once again dominated by the five largest tech stocks (“Magnificent Five”). Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL/GOOG), Amazon (AMZN), and Nvidia (NVDA) contribute about 30% to the S&P 500’s market capitalization and have a significant influence on the entire US stock market as well as the MSCI World Index due to their high market capitalisation and leading positions in areas such as artificial intelligence, cloud computing, and semiconductors.

Similarly, the allocation to US stocks has reached a historic high, with 36% of participants in Bank of America’s December survey indicating they are overweight in US stocks. This increase in US stock allocation coincides with a record low in cash holdings and a three-year high in global risk appetite, indicating an extremely optimistic sentiment among investors.

6.4 Dow Jones posts longest losing streak since 1974

Dow Jones Industrial Average Index, daily chart as of December 19th, 2024. Source: Tradingview

Dow Jones Industrial Average Index, daily chart as of December 19th, 2024. Source: Tradingview

Despite partially absurd valuations among the five largest tech stocks, US stock markets still have significant catch-up potential in breadth. So far, there are no sustainable signs that the bull market could end soon. However, after the strong year-end rally, the air has become thinner. Not surprisingly, the Dow Jones has fallen for ten consecutive days since its new all-time high of 45,065 points on 4th December, presenting its longest losing streak since 1974! The S&P 500 consolidated sideways during the same period. At the same time, the Dow Jones is heavily oversold on its daily chart, making a significant recovery or bounce already foreseeable.

While the crack-up boom could continue into 2025, the USA faces major financial challenges as necessary cuts in government spending and inflation risks determine the outlook. The easing of Fed policy in an environment of persistent inflation is already reaching its limits, as long-term interest rates no longer follow the Fed’s guidelines. The US economy is thus at a critical point as fiscal policy comes to the fore. Government spending is not sustainable. Donald Trump will have to address these problems in the new year. The base scenario assumes painful spending cuts of about USD 500 billion, which will not completely eliminate the deficit. Failure would exacerbate inflation risks and lead to higher long-term interest rates and potential market volatility. Despite positive factors such as profit growth and low unemployment, high valuations and inflation risks caution against overweighting the US stock market.

6.5 India might still be a good diversification opportunity for 2025

Inflationary pressure, fiscal uncertainty, and de-dollarisation trends will support the established bull markets in precious metals and Bitcoin. Investors should maintain their positions in these assets as fundamental inflation hedges. In parallel, the next phase of Artificial Intelligence is driving broader market advantages for the USA and especially for India, which could offer good opportunities in the new year with its rapid growth.

6.6 Fartcoin – They Will Write Books About This One

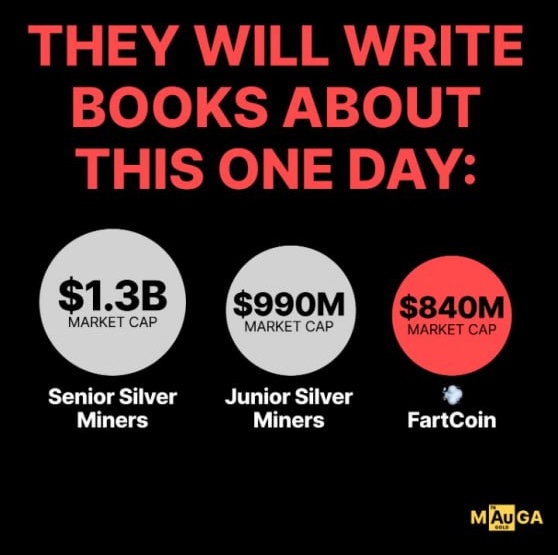

Fartcoin – They Will Write Books About This One. Source: Internet Meme

Nevertheless, the absurdity of financial markets is reaching a new all-time high these days, as the cryptocurrency Fartcoin (FARTUSD), literally based on a joke, has reached a market capitalisation of over USD 1 billion last week, surpassing the sum of all junior silver mining companies! This grotesque development underscores the increasing irrationality of the markets. While many financial jugglers could certainly benefit from a bit more wit and good humour, the fact that a meme token without real utility or substance can increase by over 6,000% in less than two months clearly demonstrates the distortions and speculative excesses in the international financial casino.

7. Conclusion: Gold – Trend Reversal right after the last US interest rate decision of 2024

Gold is rapidly approaching the end of an exceptionally successful year. While a troy ounce was trading at USD 2,062 on the spot market at the beginning of the year, it now costs USD 2,615, an increase of around 27%.

Following an overall strong upward movement, gold reached a new all-time high of USD 2,790 at the end of October and has been correcting in recent weeks. The initial sell-off low at USD 2,535 already led to a significant recovery and several weeks of sideways trading at a high level.

With last week’s low at USD 2,583 and the recovery since then, the correction may now have concluded as expected. Consequently, the interrupted upward movement should soon resume. With positive seasonality as a tailwind, gold could start flirting with the major psychological level of USD 3,000 for the first time until the summer of 2025.

7.1 Silver set for explosive upside

We are even more optimistic about the silver price and expect that in the coming months, silver bulls will finally leave behind the trading range of the last four years below USD 30. The all-time high around USD 50 should then act like a magnet, magically attracting prices. A breakthrough above the year’s highs of USD 32.50 and USD 34.86 could trigger a euphoric rally in the silver market and catapult prices towards the all-time high.

Of course, we don’t have a crystal ball, so we also have to talk about possible alternative scenarios. Should the gold price fall below the low of USD 2,535, we would become much more cautious and expect to see gold dropping towards the rapidly rising 200-day moving average (USD 2,474).

“23rd December 2024, Gold – Trend Reversal right after the last US interest rate decision of 2024” – analysis was initially published on 19th December 2024 by www.celticgold.de and translated into English on 23rd December 2024.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

Disclosure:

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

About the Author: Florian Grummes

Florian Grummes is an independent financial analyst, advisor, consultant, mentor, trader & investor as well as an international speaker with more than 30 years of experience in financial markets.

Florian is the founder and managing director of his company Midas Touch Consulting, which is specialized in trading & investments as well as consulting, analysis & research with a focus on precious metals, commodities and digital assets.

Via Midas Touch Consulting he is publishing daily and weekly gold, silver, bitcoin & cryptocurrency analysis for his numerous international readers. Florian is well known for combining technical, fundamental/macro and sentiment analysis into one often accurate conclusion about the markets.