While the Bitcoin Spot-ETF approval had marked a short-term top, prices pulled back sharply as expected. However, four weeks since the approval and BlackRock’s spot Bitcoin ETF has overtaken Grayscale’s GBTC in daily volume. Consequently, Bitcoin prices have recovered up to USD 44,500. Bitcoin – Initial recovery following the bear market has likely come to an end.

1. Review

As anticipated, the official approval of the 11 Bitcoin Spot-ETFs on 11th January marked a peak for Bitcoin prices. Our target price of USD48,500, set in January 2023, was impeccably reached and executed with a peak value of USD 49,048. Profit-taking immediately ensued, causing Bitcoin prices to sharply decline within a few hours. After months of increasing enthusiasm in the sector, the anticipated ETF approval triggered a “sell the news” event.

Over the following 12 days, Bitcoin prices continued to fall. It wasn’t until USD 38,505 that more buyers than sellers showed up again. Since then, Bitcoin has managed to recover to USD 44,766. While an end to the recovery is not yet apparent, Bitcoin prices have been consolidating around the USD 43,000 mark for several days. Only in the last two days prices managed to push slightly higher again.

1.1 Bitcoin – Initial recovery following the bear market has likely come to an end

In the broader picture, it would be surprising if the 14-month-long initial recovery (+217%) following the bear market had already been corrected with a mere 21.5% pullback within 12 days. It seems more realistic that a much larger correction, both in terms of price and especially time, will be necessary to fully cleanse the euphoric and greedy sentiment. Only then would the foundation be laid for a new bull market.

2. Technical Analysis for Bitcoin in US-Dollar

2.1 Bitcoin Weekly Chart – The conclusion of the initial recovery following the bear market

Bitcoin in USD, weekly chart as of February 8th, 2024. Source: Tradingview

Bitcoin in USD, weekly chart as of February 8th, 2024. Source: Tradingview

Since the low of USD 15,479 on 21st November, 2022, Bitcoin prices have remarkably recovered by 216.87% over the course of 14 months. The peak of this recovery was observed on 11th January 2024, at USD 49,048. As predicted, Bitcoin has reclaimed approximately 61.8% (= USD 48,555) of the preceding bear market.

The immediate profit-taking and subsequent sharp price retracement to USD 38,505 (-21.5%) were also anticipated. As long as Bitcoin cannot surpass the psychological round number of USD 50,000 on a weekly and monthly closing basis, the first recovery movement after the bear market has likely concluded.

This implies that Bitcoin prices should explore at least a secondary support level in the coming months, ranging somewhere between USD 28,000 and USD 35,000. A deeper retracement towards USD 15,000 to USD 25,000 cannot be ruled out, as in previous cycles, there has been a tendency for a kind of double bottom (in 2018 = USD 3,122 and in 2020 = USD 3,850 as well as in 2015 = USD 152 and USD 198). In a serious financial crisis, Bitcoin could even retreat to the shallow uptrend in the range between USD 7,500 and USD 11,000. In any case, the retracement would need to be substantial enough to completely correct the overly optimistic sentiment and turn it into pessimism.

2.2 No technical confirmation for a trend reversal yet

However, from a technical chart perspective, the presumed trend reversal has not been confirmed so far. While the stochastic oscillator on the weekly chart had clearly turned downwards, the price action has been moving sideways since early December. Following the rally back towards USD 44,500, the oscillator has slightly flipped back up. Consequently, only a breach of the low from 23rd January at USD 38,505 would bring clarity. At the same time, the upper Bollinger Band (USD 49,367) is blocking any potential upward movement.

In summary, the weekly chart is currently at best neutral. Although the 14-month recovery or upward trend since November 2022 remains intact, the bulls must end the current consolidation in their favor as soon as possible. Otherwise, the momentum will continue to fade, and a persistent sideways phase may simply continue.

More likely, however, is that the ongoing recovery in the range of approximately USD 44,000 to USD 47,000 will mark a lower high. Subsequently, there would need to be a break below the support at USD 38,500. This would confirm the end of the first significant recovery movement after the bear market, activating downside targets at USD 35,000 and USD 32,000.

2.3 Daily Chart – Right shoulder between approx. USD 44,000 and USD 47,000

Bitcoin in USD, daily chart as of February 8th, 2024. Source: Tradingview

Bitcoin in USD, daily chart as of February 8th, 2024. Source: Tradingview

The daily chart continues to highlight the rather steep ascent since mid-October. For about three months, market participants priced in the approval of the 11 Bitcoin Spot-ETFs in advance. The ETF trading commencement then brought the final peak and a sharp reversal, followed by a significant retracement (21.5%).

However, the original starting point of the speculation wave at around USD 28,000 has not been reached at all with this initial retracement. A normal and healthy correction, however, should unfold over many weeks or even months over the course of this year and would need to bring Bitcoin prices back to the range between USD 25,000 and USD 28,000. Only then would the ETF speculation be cleansed.

2.4 Potential head and shoulders formation

Therefore, it seems unsurprising that a head and shoulders formation is taking shape as a potential top on the daily chart. Currently, Bitcoin is already working on the right shoulder, with its peak likely to be found in the range between USD 44,000 and USD 47,000. Subsequently, a decline below the neckline in the range around USD 37,500 would activate the formation. The price target would be approximately USD 28,000, roughly corresponding with the starting point of the ETF speculation. The 61.8% retracement of the entire recovery since November 2022 also awaits at USD 28,302 in this area.

On the way down, only the rapidly rising 200-day moving average (USD 34,516) and the July high around USD 31,800 provide notable support.

Overall, the daily chart is still slightly bullish as the recovery after the initial sell-off does not seem to be over. Nevertheless, the remaining upside potential, around USD 44,000 to USD 47,000, is likely limited. The risk of Bitcoin turning downward either earlier or quite suddenly is high. Nevertheless, further peaks toward USD 49,000 and possibly even USD 50,000 cannot be entirely ruled out. Confirmation of a trend reversal would occur below USD 38,500. The activation of the price target from the head and shoulders formation at around USD 28,000 would occur below USD 37,500.

3. Sentiment Bitcoin – Optimism remains elevated despite the pullback

Crypto Fear & Greed Index long term, as of February 5th, 2024. Source: Lookintobitcoin

Crypto Fear & Greed Index long term, as of February 5th, 2024. Source: Lookintobitcoin

The Crypto Fear & Greed Index reached its highest level since November 2021, hitting 73 out of 100 points on 10th January. The pervasive optimism and corresponding greed were palpable everywhere. The few critical or skeptical voices were, as usual, ignored or fiercely attacked at major turning points.

Due to the retracement, sentiment values have retraced to a respectable level, currently standing at 60 out of 100 points. However, we suspect that the recovery since November 2021 is, similar to the situation in 2019, merely an initial response to the brutal bear market. In this scenario, a sentiment adjustment would be necessary in the coming months before a true new bull market could kick off in the crypto sector.

Overall, the sentiment remains overly optimistic, providing no contrarian buying opportunity at this time.

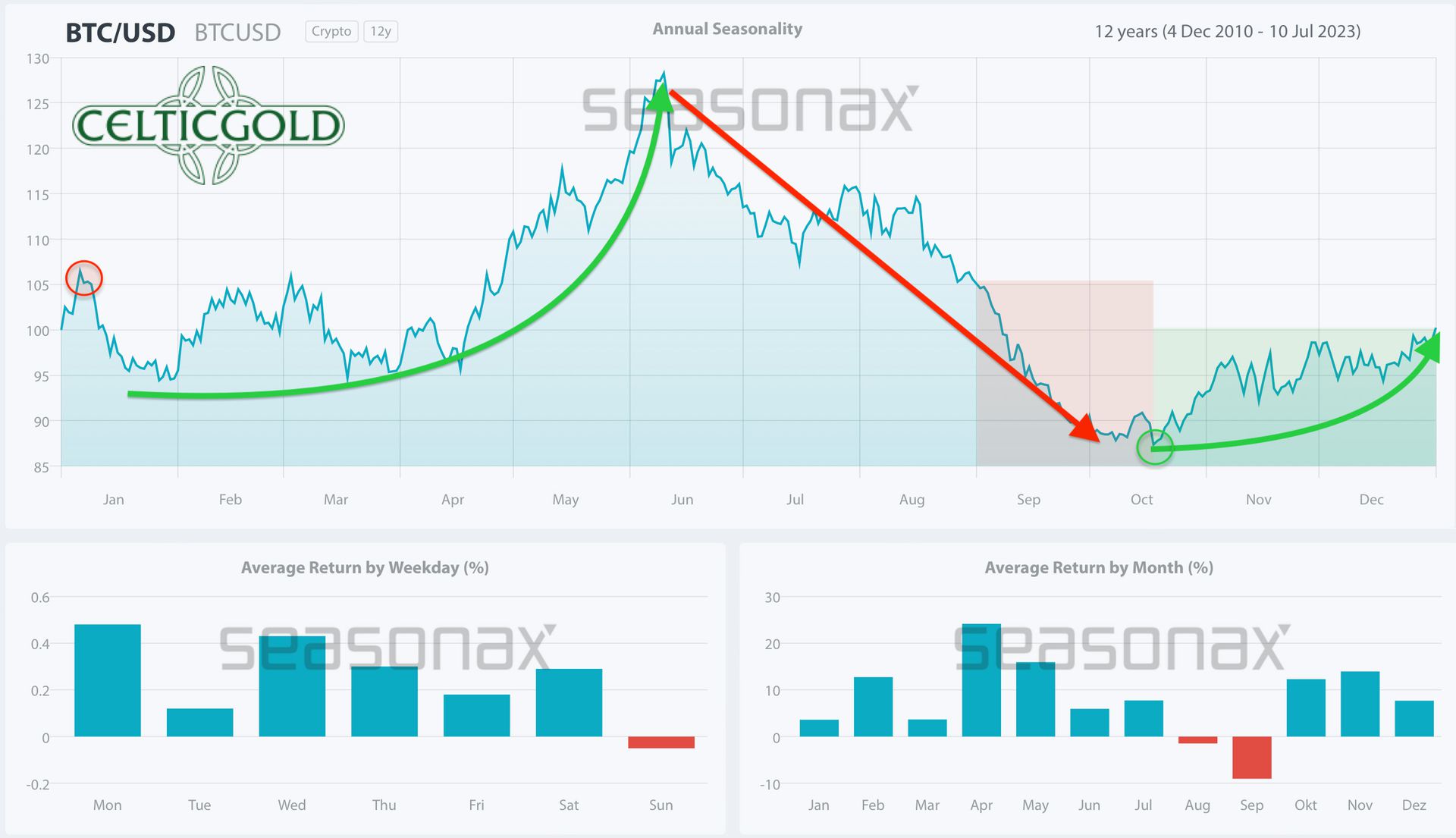

4. Seasonality Bitcoin – Seasonality only becomes favorable again from mid-April onwards

Seasonality for Bitcoin, as of February 2nd, 2024. Source: Seasonax

Seasonality for Bitcoin, as of February 2nd, 2024. Source: Seasonax

So far, the peak on 11th January fits well into the seasonal pattern that Bitcoin has developed over the last 13 years. Statistically, a rally usually follows a bottoming process between late September and mid-October, lasting until early January. From the second or third week of January, price action typically enters a corrective phase, which usually persists until mid-April, characterised more by time than by price.

Accordingly, Bitcoin is expected to trade primarily sideways in the next three months, and any attempts to break above USD 50,000 would likely initially fail. Similarly, no significant disruptions are anticipated on the downside either. Hence, the zone between USD 34,500 and USD 38,500 should hold.

In summary, seasonality is now neutral to bearish until early April. Only from mid-April, the outlook turns positive or bullish for approximately two months.

5. Sound Money: Bitcoin vs. Gold

Bitcoin/Gold-Ratio, weekly chart as of February 8th, 2024. Source: Tradingview

Bitcoin/Gold-Ratio, weekly chart as of February 8th, 2024. Source: Tradingview

With Bitcoin trading at around USD 44,500 and gold at around USD 2,035 per ounce, you would currently need approximately 21.86 ounces of gold to acquire one Bitcoin. Conversely, an ounce of gold costs approximately 0.046 Bitcoin.

Starting from levels at around 9, the Bitcoin/Gold-ratio had significantly recovered in the past 14 months towards 24 in favour of Bitcoin. While this uptrend is still somewhat intact, signs of a potential trend reversal are gradually increasing. On the weekly chart, a clear sell signal from the Stochastic oscillator and a breach of the uptrend-line of the last four months are currently absent, though.

If the Bitcoin/Gold-ratio fails to overcome the strong resistance zone around 24, a pullback to the range between 16 and 18 would be likely.

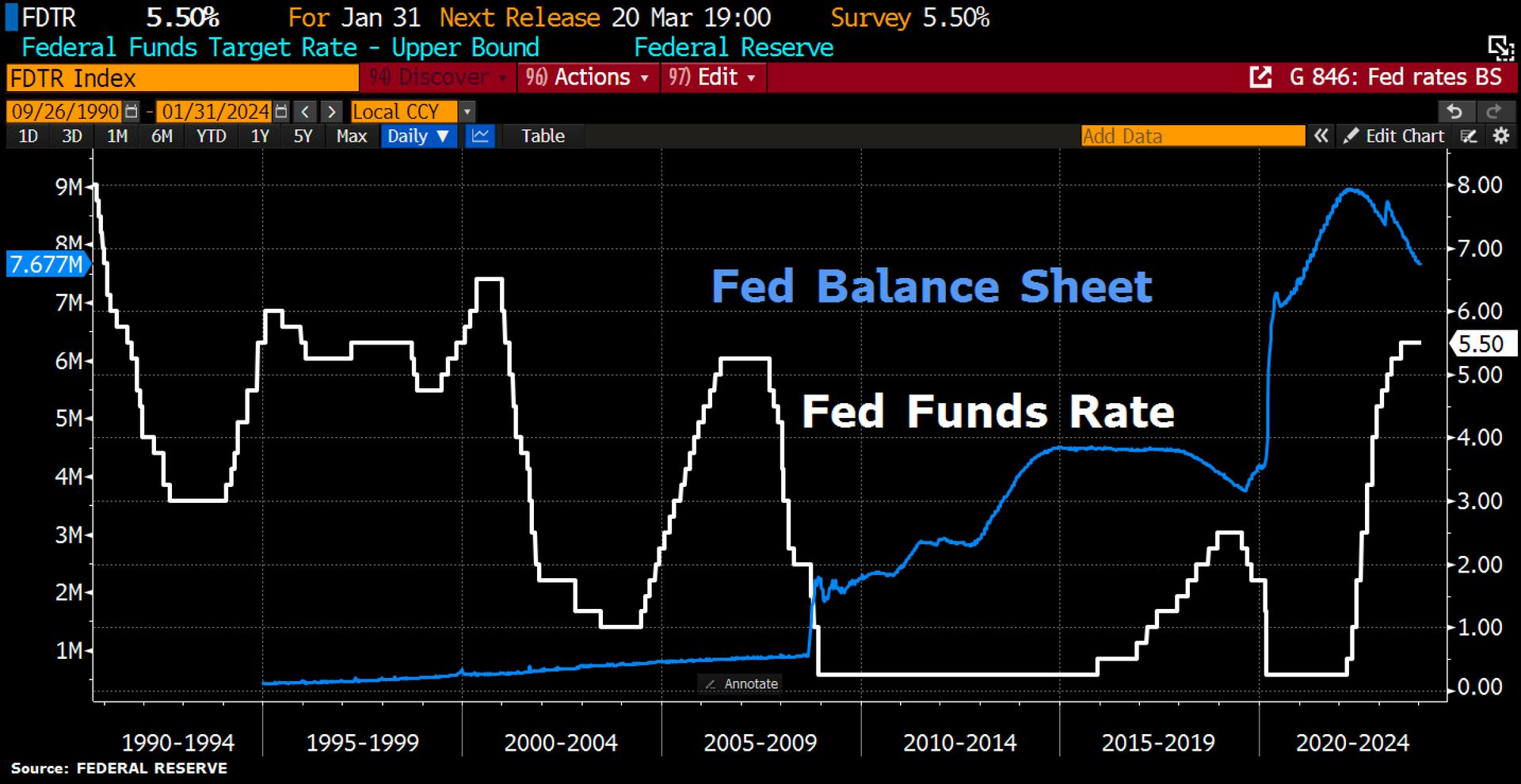

6. Macro Update – Crack-up-boom or crash landing

Fed Funds Target Rate as of February 2nd, 2024. Source: Holger Zschaepitz.

Fed Funds Target Rate as of February 2nd, 2024. Source: Holger Zschaepitz.

While the Fed more or less ruled out an interest rate cut in March just a week ago, last Friday saw the announcement of 353,000 new jobs created in January in the US. As a result, the probability of an interest rate cut in March has now dropped to only 16.5%.

Despite the sharply rising interest rates over the past two years, it seems the US economy is not yet being stifled. At least, US consumers have been able to gradually digest the higher interest rates in the US real estate market due to the long-running mortgage terms. Simultaneously, the generous US fiscal policy has been a significant contributor to new job creation in the public sector.

However, this has led to the US national debt growing at a rate of over USD 3 trillion per year, faster than ever before in US history. By early 2026, the US national debt is projected to exceed USD 40 trillion! In the event of a recession, this could happen even sooner.

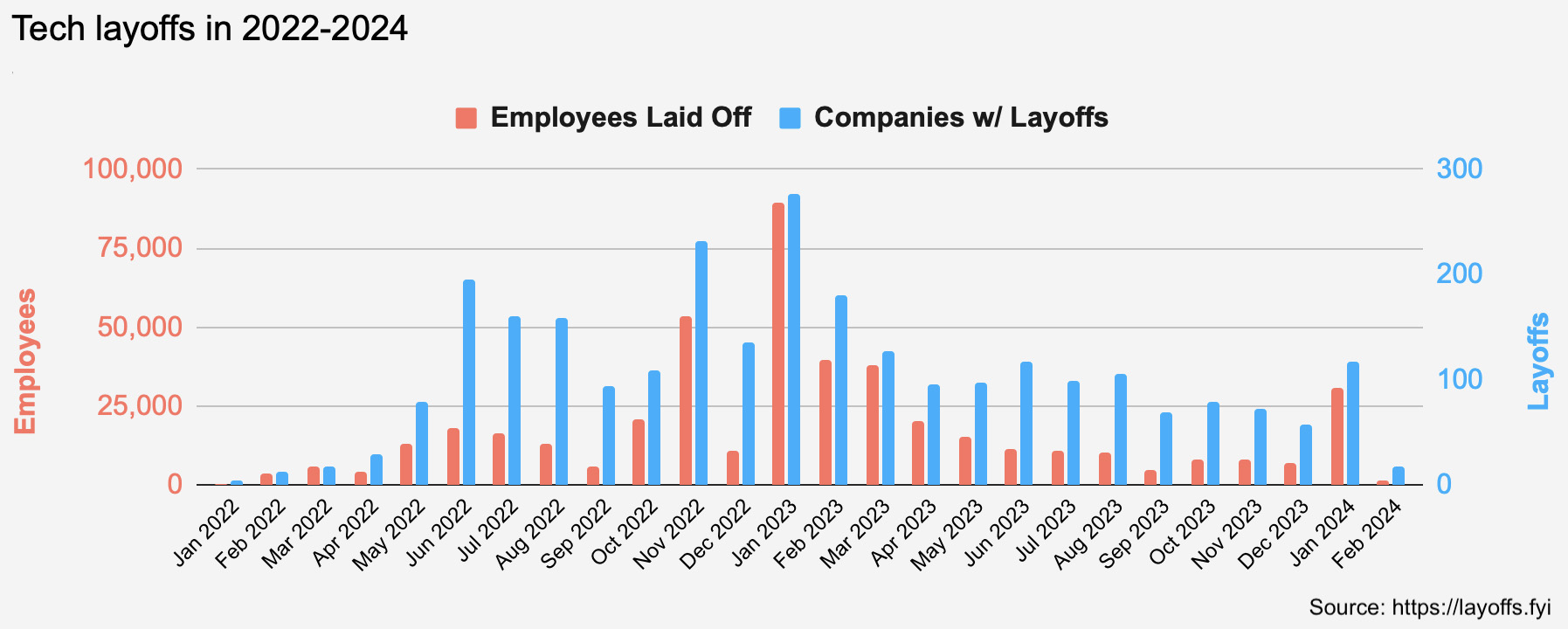

6.1 2024 kicked off with another wave of job cuts in the tech sector

Tech Layoffs in 2022-2024. Source: Layoffs.fyi.

Tech Layoffs in 2022-2024. Source: Layoffs.fyi.

At the same time, the technology sector has kicked off 2024 with another wave of job cuts. In the years 2022 and 2023, tech companies, including startups, worldwide laid off more than 425,000 employees! The new year began even worse for tech employees, with more than 122 US tech companies and startups laying off more than 31,000 employees.

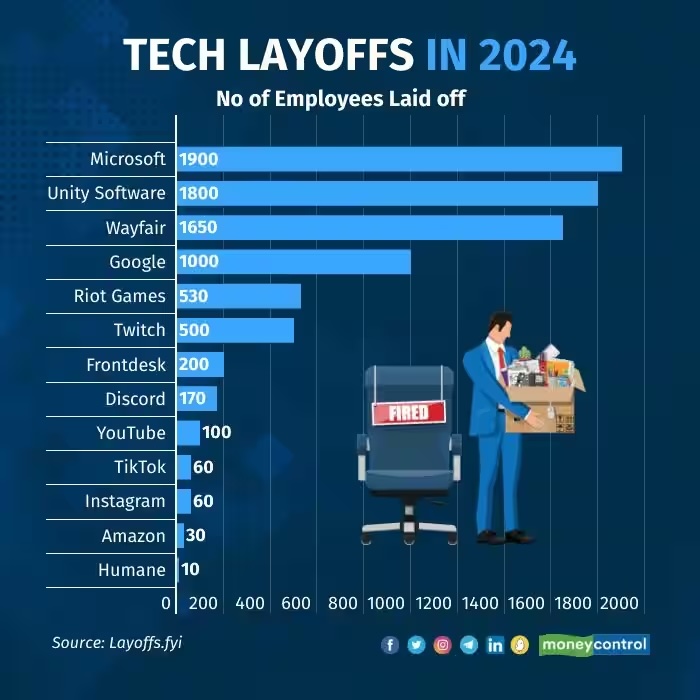

Tech Layoffs in 2024. Source: Layoffs.fyi.

These include well-known names such as Amazon, Google, Microsoft, PayPal, SAP, Riot Games, TikTok, WayFair, YouTube, Discord, Unity, and Audible. Although the dismissed programmers and software engineers may not necessarily be entirely excluded as consumers, their spending enthusiasm is likely to gradually diminish, given the high competition and the fundamental shift towards artificial intelligence (“low code” and “no code”) in the tech industry.

6.2 Stock-markets nearing bubble territory

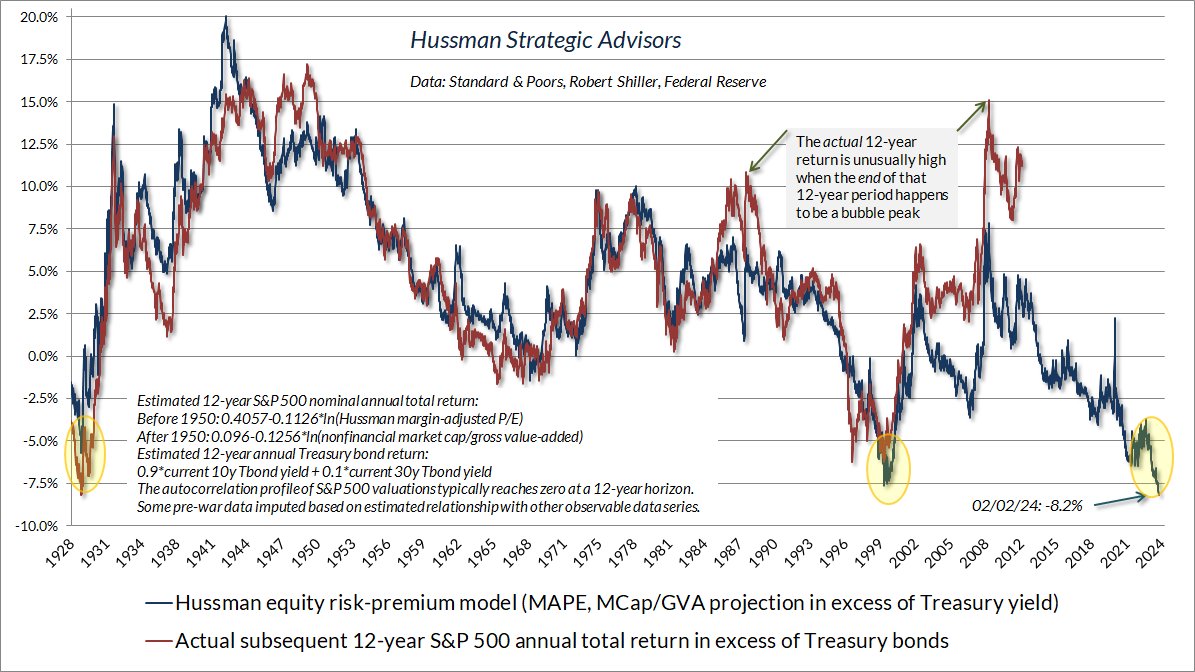

10- to 12-year S&P 500 Yields vs. US Treasury Yields. Source: Hussman Strategic Advisors.

Meanwhile, the stock markets continue to celebrate these cost reductions with new all-time highs. Many tech and AI stocks have skyrocketed in recent weeks. However, market breadth is now alarmingly narrow, with less than 40% of stocks trading above their 10-day moving average, less than 60% above their 50-day moving average, and less than 70% above their 200-day moving average. This has only happened once since 1928: on 8th August 1929! Also, the spread between the 10- and 12-year yields of the S&P 500 compared to US Treasury yields points to a bubble peak similar to August 1929 or December 1999.

6.3 Problems in the US regional banks and in US commercial real estate resurfacing

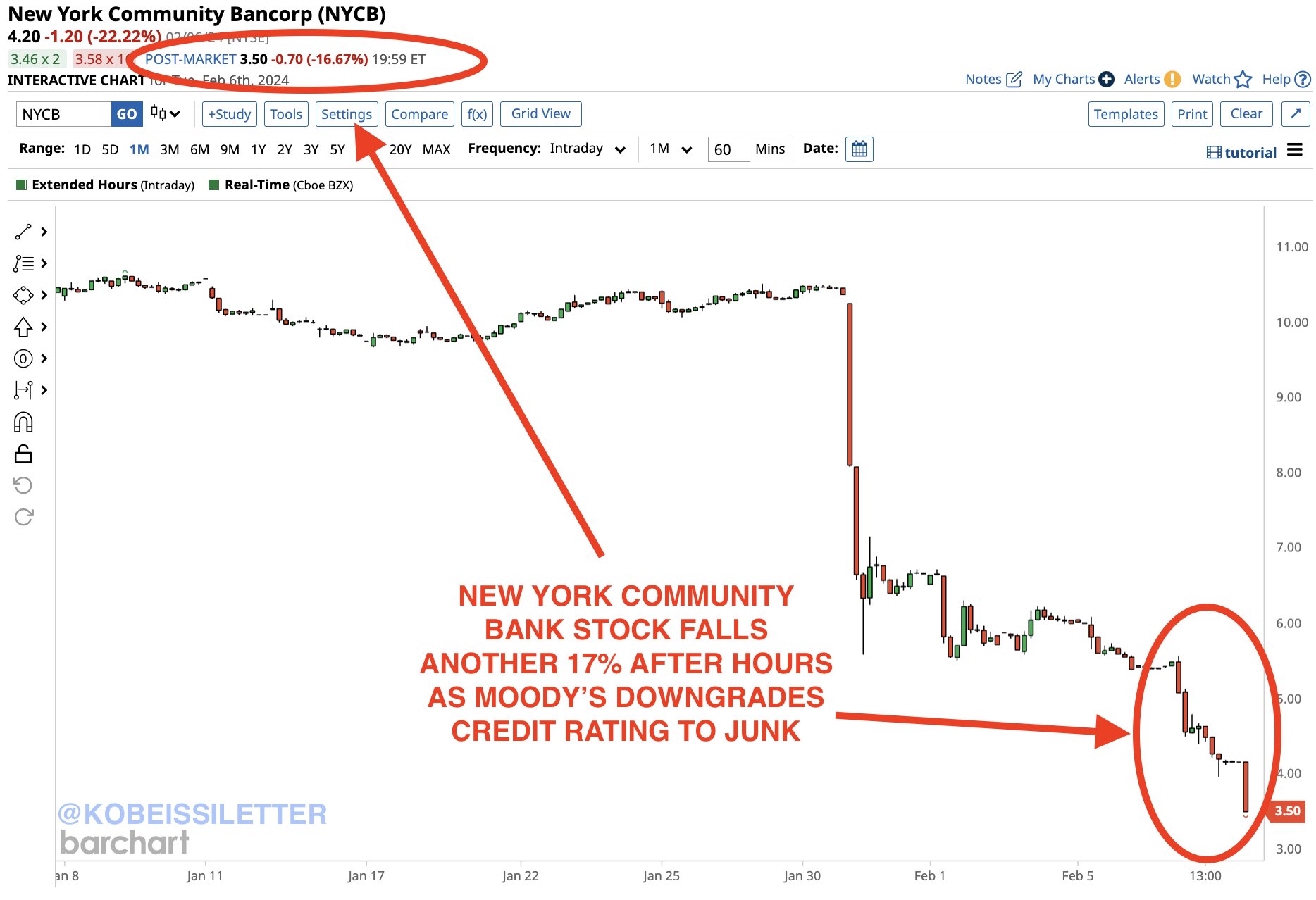

New York Community Bank ($NYCB), from February 7, 2024. Source: The Kobeissi Letter.

New York Community Bank ($NYCB), from February 7, 2024. Source: The Kobeissi Letter.

The next major crisis trigger could be the still-smouldering issues in the US banking and commercial real estate sector. The shares of New York Community Bank fell another 17% after Moody’s downgraded its credit rating to junk level. Overall, the stock price has fallen nearly 70% since the beginning of the year, and USD 7 billion in market capitalisation have been wiped out in a few weeks. Many other US regional banks have also come under significant pressure since the beginning of the year: Valley National Bank -25%, Metropolitan Bank -15%, HarborOne -14%, Comerica Bank -13%, Zions Bank -12%, Western Alliance -11%, and Citizens Financial -6%. Concerns about US regional banks, which hold almost 70% of commercial US real estate loans, are resurfacing.

At the same time, the collapse of China’s largest property developer, Evergrande, could further increase systemic risk. While the demise of the real estate giant was not surprising, as liquidity issues have been known since mid-2021, the new stimuli and QE in the trillions from China could stabilise global financial markets, at least in the best-case scenario. Simultaneously, inflation could persist due to rising commodity and energy prices, potentially fueling the crack-up boom again. This could make the Fed even more persistent against interest rate cuts initially, causing panic in liquidity-addicted financial markets.

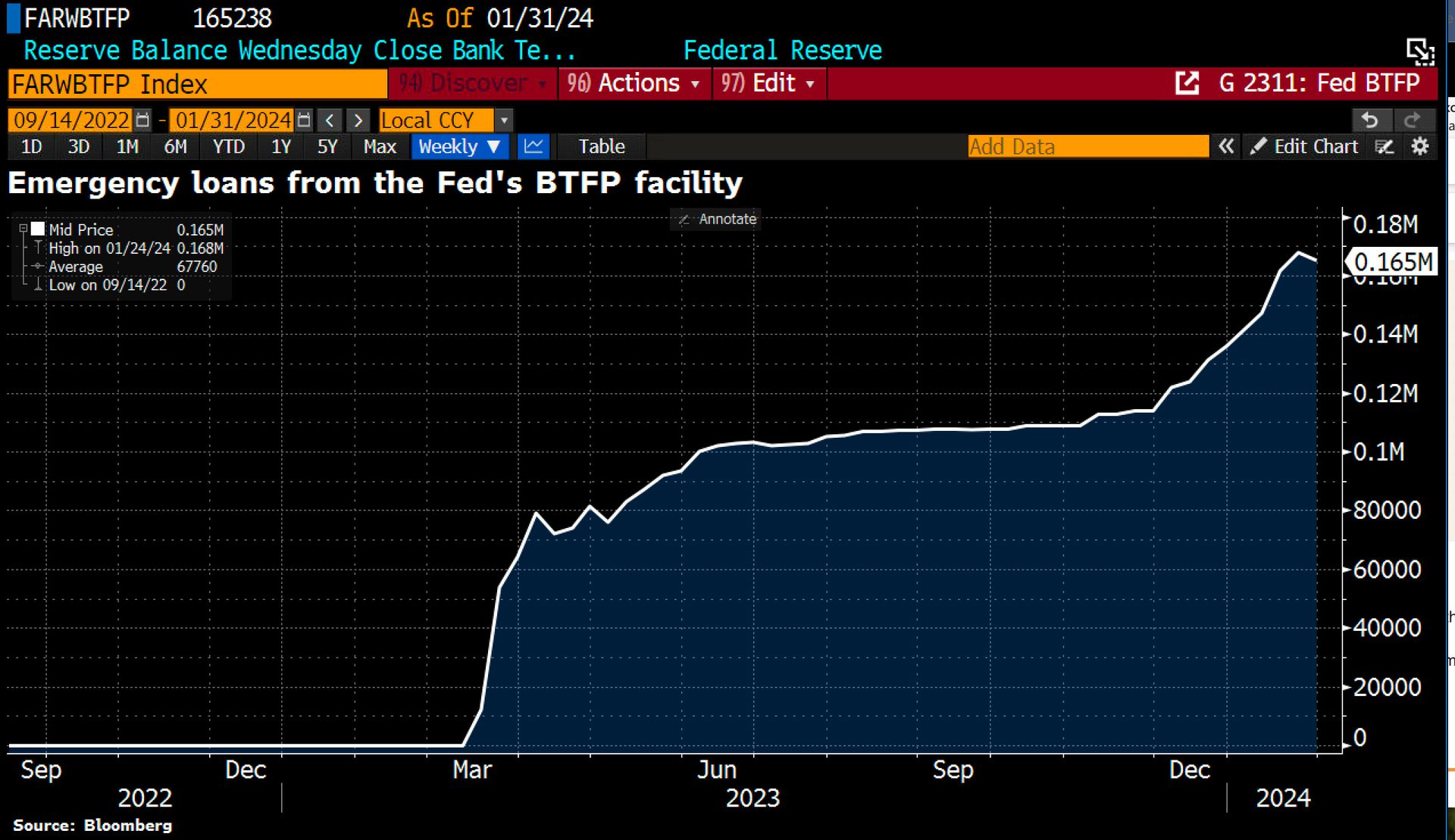

Emergency loans from the Fed’s BTFP facility as of January 31, 2024. Source: Holger Zschaepitz.

Emergency loans from the Fed’s BTFP facility as of January 31, 2024. Source: Holger Zschaepitz.

Overall, both macroeconomic data and the geopolitical situation paint an extremely unstable picture. Stock market exaggerations have a bubble-like character, while the Fed strives to reduce emergency loans from the BTFP facility and delay interest rate cuts hoped for by the market.

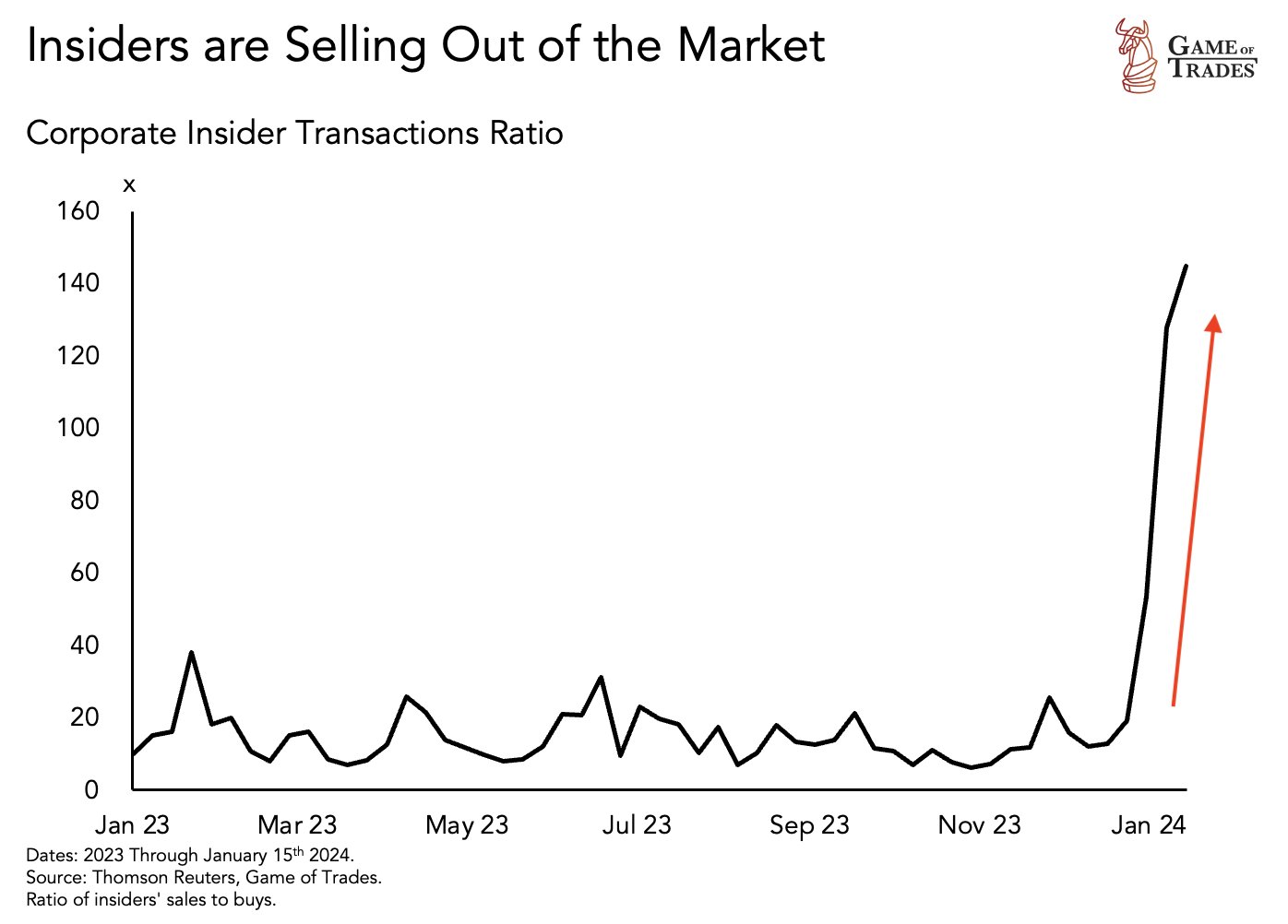

6.4 Insiders selling like never before!

Smart Money selling like never before, from February 6, 2024. Source: Games of Trades.

Smart Money selling like never before, from February 6, 2024. Source: Games of Trades.

Accordingly, the “smart money” or corporate insiders have used the past few weeks to a great extent to divest from their holdings. insiders selling like never before. Yet, dumb money confidence is extremely optimistic.

For Bitcoin, this situation is rather unfavourable. Apart from the lack of a new narrative or a “new story to tell” at the moment, the liquidity cycle is no longer expansive.

However, if the Fed is forced by the markets, similar to last year, to implement new record rescue measures within a few days or over a weekend, the situation could quickly change again.

7. Conclusion: Bitcoin – Initial recovery following the bear market has likely come to an end

We had suggested to reduce exposure into the rising Bitcoin prices in the range of around USD 48,500. So far, this plan has worked out very well, as the price peak of around USD 49,000 likely marked the end of the fourteen-month recovery. While short-term fluctuations and further price peaks may still occur, we consider the upside potential in the coming weeks and months to be very limited. Ideally, Bitcoin is forming the right shoulder of its top formation in the range between USD 44,000 and USD 47,000.

As the initial recovery following the bear market has likely come to an end, a retracement could lead back to at least the USD 28,000 range. Significantly lower prices are also conceivable, primarily depending on the extent of the foreseeable next financial crisis. However, since Bitcoin is a direct bet on fiat liquidity, hastily patched measures to rescue the old financial system could mark the beginning of a new Bitcoin bull market in a very short time. Therefore, we would recommend keeping a small Bitcoin allocation for hedging and otherwise patiently observing the developments from the sidelines.

Analysis sponsored and initially published on 7th February 2024, by www.celticgold.de. Translated into English and partially updated on 8th February 2024.

Feel free to join us in our free Telegram channel for daily real time data and a great community. If you like to get regular updates on our gold model, precious metals, commodities, and cryptocurrencies, you can also subscribe to our free newsletter.

Disclosure:

This article and the content are for informational purposes only and do not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. The views, thoughts, and opinions expressed here are the author’s alone. They do not necessarily reflect or represent the views and opinions of Midas Touch Consulting.

About the Author: Florian Grummes

Florian Grummes is an independent financial analyst, advisor, consultant, trader & investor as well as an international speaker with more than 20 years of experience in financial markets. He is specialized in precious metals, cryptocurrencies, and technical analysis. He is publishing weekly gold, silver & cryptocurrency analysis for his numerous international readers. He is also running a large telegram Channel and a Crypto Signal Service. Florian is well known for combining technical, fundamental and sentiment analysis into one accurate conclusion about the markets.