This article is in the story section of this newsletter on purpose as I’m not a scientist or professional historian. Writing about the subject ‘Natural Money’ is based on observations that come from literally thousands of hours of research about the history of money and thousands of individual chats about finance & economics.

I developed a view on how things work in these days and studied how they worked in the past when gold was in place as money. All of this experience and observation leads me to the concept of ‘Natural Money’.

But as always we’ll have accidents in our perception, so the thoughts and ideas expressed here are based on the last 15 years of observation and will be adjusted as I go along and continue learning.

In past newsletters we talked about fear, money and how gold makes you safe. In addition we discussed the manipulation tactics of central banks and governments, about currency, inflation and how the system works. By now you should have a basic knowledge and are not easily towed around by the nose.

Most of you have more than 60% of your assets in gold (and silver) and the calmness that is in everyone is very nice to see. My old teacher said calmness comes from detachment. Being detached from the paper-currency and the manufactured ups and downs from the Central Banks must be a good thing then.

Let’s get started.

When we look at nature we can learn and observe the ‘nature’ of our surroundings. How things relate with each other, how they behave and how we relate to other people, nature, animals and objects.

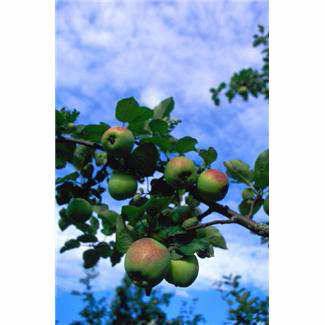

Looking at how nature works, I can see abundance, balance, movement and natural effort and of course lots of other things. But this is what I will focus on to explain the concept of natural money. Stick a potato in the ground and watch a plant growing that brings you 10+ potatoes. Or look at a tiny carrot seed and after a couple of months pull out a big carrot. Or an apple tree that’s hanging full of apples. And the sun is shining on our land making everything grow – this is abundance.

(natural abundance)

(natural abundance)

Another aspect of nature is movement and balancing. We can’t make the earth spin a bit faster or slower, make spring coming faster or change the weather as we like. Nature balances and regulates itself by moving.

Those of you that understand Rolfing (Rolfing is a deep tissue massage technique) may know that one of the core beliefs of Rolfing is movement. Everything moves all day; inside and outside the human body. The kidneys walk a distance of 600 to 800 meters every day just by breathing. In a bigger context the Rolfer beliefs that the core motivation of a human is: ‘A stomach moving towards food.’ Again movement is key, but that is only on a side note.

Let’s move now to one aspect of human life: Money.

Money per definition has value in itself. It is a store of wealth. Money can always be currency but not the other way around. Let’s look at the term currency. Bank notes are an agreement, a currency, a medium of exchange to purchase products and services; to buy assets. A currency is not a store of value. It’s a ‘current’ that needs to float around otherwise it dies off, like electricity. A 50 EUR bank note is worth the intrinsic value of the paper and ink but nothing more.

Currency in the best case is backed by real money = something intrinsic = Gold and silver.

But we all know in today’s world, a currency is backed by a governments promise to pay.

Throughout history we learned that ‘The barter system’ doesn’t work as we have different needs and one of the natural aspects of an apple is that it goes rotten after a while. Meaning the apple farmer, the fisherman and grocery merchant have different needs than a carpenter or stone manufacturer as they are dealing with different products.

To balance the different needs we invented something called money. From what I have learned people throughout history have experimented with different ways to exchange goods and services to see what works best. Looking at what would work as money we can rule out everything that changes its state over time. For example a fish wouldn’t do and a vegetable wouldn’t do as everyone agrees on that point.

(Fish is not suitable as money)

(Fish is not suitable as money)

So we’re looking at something timeless – a good that holds its state over time; is durable. What about stones? There are plenty of stones everywhere and a stone lasts a long time. I’m sure you would say: No, no. A stone doesn’t work, there’s too much of them and how do you determine what the value is? Where’s the measure and what stones are money and which ones are not?

Right, stones wouldn’t work. So we’re looking at something that is timeless but rare. Following this thread leads to the aspects of money. Money must be: Not easily counterfeited, rare, indefinitely durable, have a worldwide standard, be natural and limited.

Everything on this planet has a purpose. Like using a stone to build houses and eating an apple to stay healthy and fed. So we’re looking for something that has the purpose ‘money’. Through the trial and error system we found something that actually has the purpose of money: Gold and silver. Gold and silver match all of the above money criteria.

Using gold as money has a natural balancing character. I like to look at this subject in more depth, as balance seems to be not of interest to people in current times. With balance we need to look at boundary. We have one planet not two. If we wreck this one, we can’t move to another one. So the space that we’re in is naturally limited. Everything that is adjacent to this natural aspect – like paper-currency – needs to be balanced out as it is not in harmony with nature. Here you find the explanation of all the bubbles, hypes and crashes. It’s the foundation of our monetary system. The balancing factor is the crash after the hype. Just like the hangover after too much pub.

So money and the money supply – if natural – must be limited and constant. Guess what gold is; limited and constant. Because circulating gold as money can’t be increased with a mouse click there is expansion and contraction.

Like a muscle. If you move your arm, one muscle is expanding; the other is contracting – natural, easy. Everyone that ever lifted a pint in the pub knows how it works. But that’s in the ‘A stomach moving towards food’ department. Back to how economic expansion and contraction should work.

Let’s look at an example; Countries buy and sell commodities from each other and pay in gold. The gold moves in exchange from country A to country B. Country B exchanged their commodity for gold and is now able to buy other needed commodities from a different country or store the gold. The traded commodity has now moved out of the country and can’t be used for the countries own production.

Country A who bought the commodity can now produce other goods and sell the goods back to people who pay in gold or country B that needs the ready produced goods. The gold returns, the game starts again.

That’s a natural cycle. You can’t spend more than you have or you can’t eat an apple that is not ripe. I guess we all tried that as children. Must have been funny to watch people’s faces biting in an apple that is not ripe.

So using gold as money regulates itself automatically. Because it’s a natural aspect of gold to regulate markets; we don’t need a government to control markets or to stimulate them. Gold is the natural constant and measure that many economic scientists write about. (Learn more about the ‘Golden Constant’ ISBN-13: 978-1847202611).

So in a way all the hype and the massively important G20-what-not-summits and stuff is not needed if we leave the regulation to nature itself by returning to a gold standard. Let’s now look at natural effort.

It takes effort to move you from the sofa to the pub but it’s not struggle. It takes effort for an apple tree to grow apples or for a bulb to flower. I’ve never heard an apple tree saying, ‘Jeez this is really a struggle to grow all these apples, man.’

So effort is normal and natural. It takes effort to mine the gold and it takes effort to produce goods, to haul around stuff, to chop some wood in order to have it warm and cosy in the evening.

There is no effort in paper-currency. It just takes a mouse click to create another 100 billion that wasn’t there a second ago. So, say there was 1 trillion of currency floating around, the central bank prints 10% more. The purchasing power of your savings account, bonds, shares etc. was devalued by 10%. When you look at your account statement it doesn’t say you lost 10%. To understand how much you lost, you must compare how much more currency was created. In these days nothing of intrinsic value increased at the same rate that would justify a 10% (for example) increase of currency supply. There are not 10% more cars on the streets or houses built and the amount of wheat that can grow on a hectare of land is pretty constant under normal circumstances.

(Currency creation today)

(Currency creation today)

And if you invested in shares and the share doesn’t go up by the same 10% you have lost as well. In fact if you look the stock market indexes compared to currency supply, you find that you lost about 67% in the Dow Jones. The up-movement of the Dow Jones suggested you’d made a 20% profit in the same time. But that is just another mechanism that deludes us from the real devaluation. (Source: Michael Maloney: Guide to investing in gold and silver.)

We can see that this is not natural. The natural way is to benefit not to harm. One clove of garlic grows a whole bulb with an average 10 cloves – that’s abundance, that’s beneficial.

In my view gold is a natural good and its purpose is money. You can’t eat it and you can’t use it for production in many industrial products. The amount the industry can use gold for is very low and most of the industrial gold is recycled and reused. So from studying history I have concluded the only purpose is as a store of wealth = money. Money that preserves its purchasing power for generations without inflation and scares. On a side note, most gold is used in jewellery but one needs to understand that most of the gold is in Asia. And in Asia gold-jewellery is used as money, especially India.

If there is a different system in place, gold always tells us the truth by indicating how much a currency devalues compared to gold. Meaning it adjusts to inflation automatically without any extra cost or struggle. Keep in mind that today you could buy the same amount of ‘stuff’ with the same amount of gold as you could a couple of hundred years ago.

And remember that rising gold prices only indicate inflation. That means gold has a long way to go before it reaches its ultimate purchasing power as there is much more money printing to come and much more manipulation to be exposed which drive gold prices much higher.