Many thanks to a dear customer who asked if we could address this subject, this is very interesting.

The BBC back in June published an article about gold vending machines. Our customer summarized the BBC article in that way: The BBC guy was stopping and asking people in the street what they thought of those gold machines and if they would ever consider buying gold from them. Quite a few of the women said they would rather go into a jewellery shop and buy a piece of gold jewellery, than put money into a machine and get a gold ingot. One of them said "Well, what would you DO with a gold ingot? At least with a piece of gold jewellery you can wear it."! (Please read here the full article: http://www.bbc.co.uk/news/business-13998238 ).

So the most obvious question from an investor’s point of view is: Which form of precious metal is a better investment?

Let’s look at the Pro’s and Con’s of Jewellery:

First we need to look into the purity of jewellery. Most necklaces, bracelets and rings on the market have a purity between 9k and 18k that equals 375 and 750/1,000 metric purity. You can check your jewellery by looking at the tiny stamp with either a three digit number ‘375’ for example or the purity printed in karat for

example ‘9k’. Meaning the piece of jewellery that you picked contains 375 parts of pure gold out of 1,000 parts. The remaining 625 parts are usually copper, silver and a bit of other metals.

This picture shows the stamp of a silver ring with a purity of 925/1,000.

order to have a comparable example I picked a 22k necklace as it’s easy to compare with a Krugerrand gold coin. (Please find out more about the different gold and silver coins and purities in the newsletter from 13th August 2011).

This necklace weighs 11.2 grams; made out of 22K gold and costs $823.

The necklace used for this example can be found at:

https://www.goldpalace.com/mm5/merchant.mvc?Session_ID=343c32ef

0ca051cca7d4e940288cbeeb&Screen=PROD&Product_Code=31780

To get a comparable figure we need to multiply the weight of the necklace to the exact amount of one ounce of pure gold as a necklace. In this case you would have to pay $2,493.25.

($823 divided by 11.2 gram = price per 1 gram of necklace = $73.48 times 33.93 grams to get 1oz pure 24k gold = $2,493.25. Note the Krugerrand weighs 33.93 grams and contains 1oz of pure gold and has a purity of 22k. A 24k coin would weigh exactly 1oz = 31.10 grams, so the Krugerrand is a bit heavier to fit in one ounce of pure gold.)

In Europe an ounce of Krugerrand is traded on September 29th 2011 at 5.9% over spot, gold spot is $1,614.50 = $1,709.76 buying price for the Krugerrand.

These are the results in comparison:

Gold Necklace Krugerrand 1oz

Purity 22k 22k

Price for 1oz $2,493.25 $1,709.76

Difference +45.82% -31.43%

A 1oz Krugerrand is 31% cheaper than the same amount of jewellery. Looked from the other side jewellery is 45.82% more expensive than the same amount of gold bought as a 1oz Krugerrand coin.

From an investor’s point of view it does make sense to always have the highest purity at lowest price.

But of course you can’t stick a price on beauty. Jewellery is more expensive as the designer and goldsmith puts a lot of idea, time and work into the piece of choice to craft it beautifully.

So a fair share of the price you pay is time and surely jewellery that is crafted in Asia is much cheaper than in Europe or the United States as wages are much lower in Asia than over here.

To summarize the Pro’s and Con’s: Jewellery is beautiful but not suitable as an investment and much more expensive than the comparable gold coins or bars.

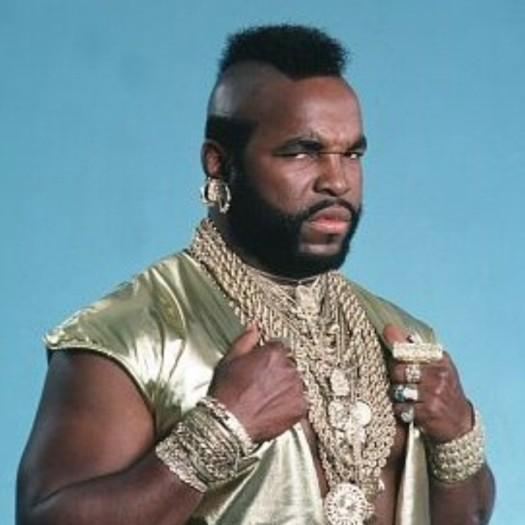

And carrying around your investment reminds me of the famous character BA Baracus in the A-Team TV show. Running around with a 100,000 EUR investment needs to be thought about, as it’s 2.5 kilo hanging around your neck. It surely trains the neck muscles well.